I've been posting more on TikTok (follow me here 👀) and I keep seeing people hyping up bankruptcy like it's a glow-up. And I need you to hear me: it is not.

It doesn't wipe your credit score. It's not a hack. And the people making it look easy are leaving out a lot.

So let's actually talk about what happens when you file.

Here’s what’s inside:

2 truths, 1 lie

Which of these is a lie? 🤔

(Actual answer at the end of the newsletter 👇)

Filing bankruptcy isn’t a financial reset button

There's a whole corner of TikTok right now where people are treating bankruptcy like some kind of financial cheat code. Like you just file, reset your credit score to zero, and start fresh with no consequences. Wild, I know.

But here's a reality check:

Yes, bankruptcy can wipe out certain debts. But it also torches your credit for the next 7-10 years, makes it nearly impossible to rent an apartment or get approved for anything, and in many cases, doesn't even discharge student loans or tax debt (basically the two things drowning most people in the first place).

I get the appeal of a "fresh start", but burning down your financial house to kill the spiders isn't the move. Find the actual exits first.

We're seeing more young people file because they're genuinely underwater. Wages haven't kept up with cost of living, and credit cards became the backup plan when savings didn't exist. The desperation is real.

What to do instead: Before you even think about bankruptcy, talk to an actual financial counselor (not just scroll on TikTok). Look into debt consolidation, negotiate with creditors, or explore hardship programs. Bankruptcy should be the last resort, not the first click.

If you need a personal finance coach to talk to, we’re here. We can guide you on your next steps.

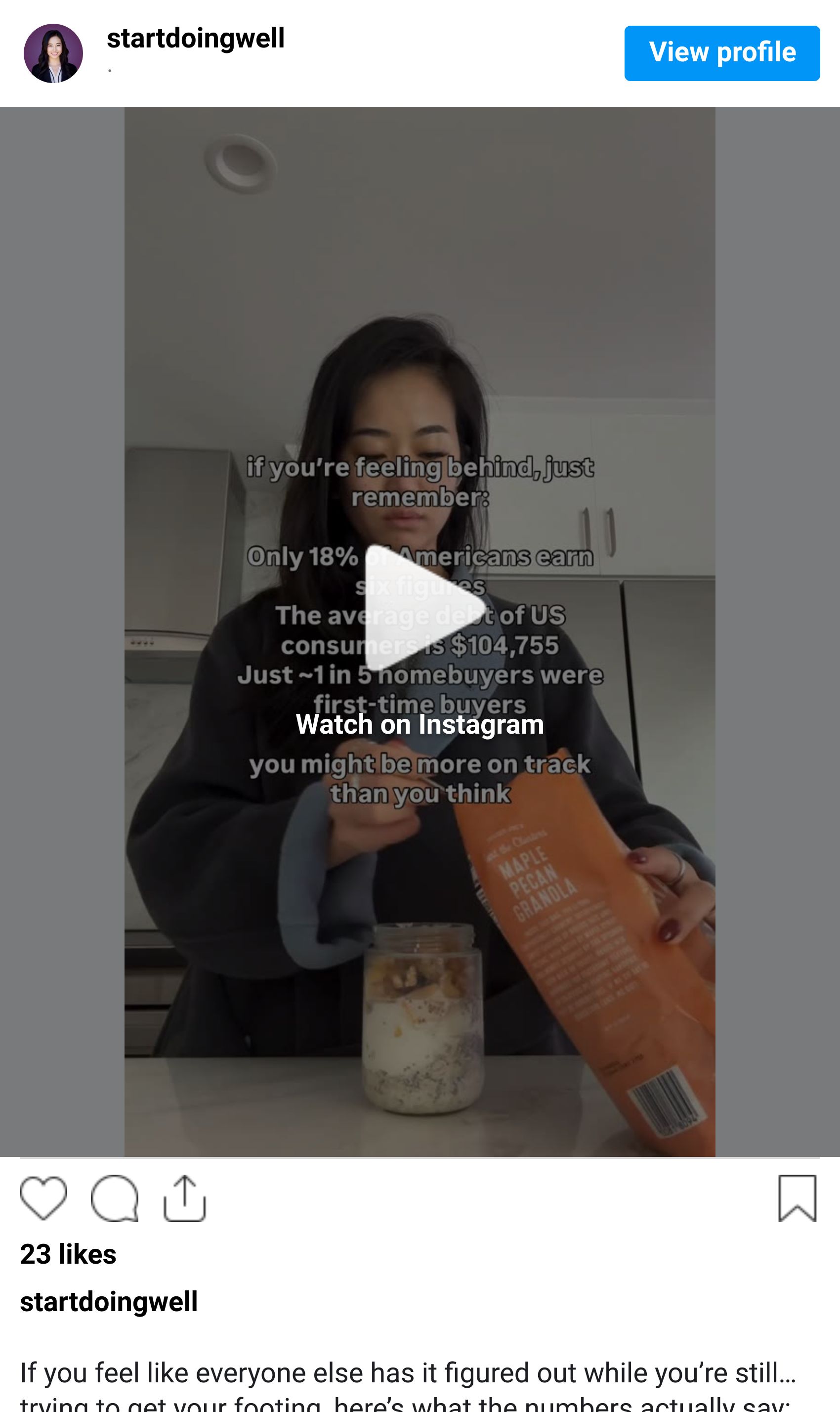

You might be more on track than you think

By the numbers

$3,800

Expected average tax refund this season

This year's refunds are hitting around $3,800 per filer, up from $2,939 last year. Sounds great, right?

Here's the thing: a bigger refund means you've been giving the government an interest-free loan all year. They held your money, paid you zero percent interest, and are now handing it back like they did you a favor.

The real question isn't "how big is my refund?" It's "why am I getting one at all?" If you're consistently getting huge refunds, adjust your W-4 withholdings so you keep more of your paycheck throughout the year (and actually do something with it).

That said, if you are getting a refund this year: use it strategically. Emergency fund, high-interest debt, or a targeted goal. Don't let it evaporate into "stuff."

$1M

What Americans say they need for retirement

A million dollars. That's the number most Americans say they need to retire. And honestly? It's not unreasonable depending on your lifestyle and timeline… but it also feels impossibly far away for most people.

The good news: you probably don't need a million to retire. The actual number depends on your expenses, where you live, and what "comfortable" means to you. A teacher retiring in Kentucky has very different needs than a tech exec in San Francisco.

Focus less on the scary headline number and more on building the habit: automate retirement contributions, take the employer match if it's offered, and increase your percentage whenever you get a raise.

$1,546

What Americans spend on food every month (groceries + dining out combined)

The breakdown: $667 on groceries, $879 on restaurants and takeout.

If you just gasped, you're not alone. Most people think they spend "maybe $400" on food. Then they actually track it and realize those "small" Uber Eats orders add up to a car payment.

I'm not here to shame anyone's DoorDash habit (I have my own on busy days), but this is one of those areas where awareness changes everything. Track your food spending for one month. Just one. You'll either feel validated or horrified. Either way, you'll have real data to work with.

Need to talk numbers? We can help you sort out your money.

Poll answer

❌ False: The average American saves only 10% of their income

The actual personal savings rate in the U.S. hovers around 3.5% - 4.1% as of November 2025.